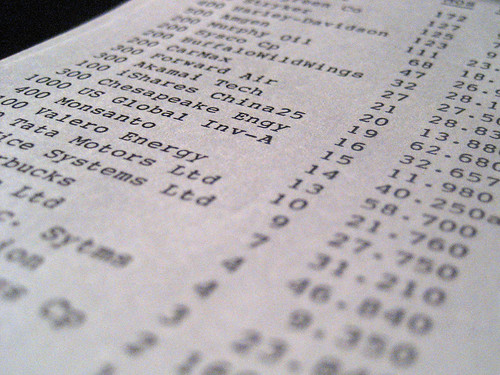

Courtesy: Iscan from Flickr

Mutual funds are one of the vehicles available for retail investors to invest in equity and debt markets. Based on the investor’s risk and investment profile, mutual fund should form part of an investor’s portfolio. This post is an elementary guide to help one understand mutual fund investment.

Understanding Mutual Funds

Mutual funds are investment instruments which collect money from various investors and invest in equities, debt or gilt as per the investment mandate. They are managed by fund houses that collect their management fees which vary depending on the type of funds being managed and can vary from 0.25% to 2.5% with actively managed equity funds charging the highest fees.

Why to invest?

As a retail investor, it is difficult for an individual to identify good stocks or bond for investment. For selecting a stock, he relies on investment tips from friends or on business channels or on available stock analyst reports. Rarely does he carry out the analysis of the company by understanding the company’s business and by reviewing its financials. This is not a correct way of investing and by doing this one is never sure whether the investment decision is right or not. Even in case he is confident about his decision at the time of investment, it becomes difficult to track the company and continuously evaluate the impact of latest developments on the company’s business.

On the other hand, mutual funds are managed by portfolio managers who are experts in their field of investments. They have specialized skills and knowledge and are able to constantly track their portfolio. Further, mutual fund can provide exposure to varied class of assets. There are mutual funds which invest in debt funds, in equities or both in debt and equities. The debt funds can be further sub-divided into short, medium or long term depending on their time horizon. Similarly, equity funds can be sector specific or index funds. Thus within mutual fund, there are various alternatives available to suit the investment and risk profile of the investor. Transparency is high and they are one of the cheapest investment avenues with the elimination of loads and curtailment of asset management fees. All this makes mutual funds an ideal instrument to take equity and debt exposure.

How to Invest?

Investment in mutual funds can be carried out either (i) through your distributor / agent / financial advisor, (ii) through your broker, (iii) directly with the fund house or (iv) through online portals. Below we discuss each mode of investment in detail.

- Investment through distributor / agent / financial advisor: These are the middle men who act as your agent. It can be your neighborhood distributor or bank or financial advisor. Based on the mutual fund scheme selected, they assist you in filling the application form, collect your cheque for investment and forward your application alongwith cheque to the mutual fund house for account opening and investment. They are your point of contact and you can contact them for further investments or for redemption or switching. Alternatively, you can also directly get in touch with the fund house for future transactions. Generally the distributor will charge you transaction fees for the services provided by them. Tip: Ensure that you fill up the application form yourself to ensure correctness.

- Investment through broker: Investors having demat accounts can also invest in mutual funds through their broker. It works just like the way you purchase equity shares from broking account. You need to identify the scheme in which you want to invest and number of units. Based on the NAV of the scheme, the corresponding amount will get deducted from your broking account. Broker will charge broking fees for the transaction and the investment will get reflected in your demat account. Now it is also possible to create an SIP through this mode of investment.

- Direct investment with fund house: If you do not want to interact with any agent, you can invest directly with the fund houses. It can be done either online or offline. Few fund houses such as HDFC like to have the first transaction offline and allows you to register for their online facility once an investment has been made. Online mode, though, is not completely paperless. After filling the online form and making payment through net banking account, you need to take a printout of the form and submit it to the fund house. Post receipt of the application form, fund house will open the folio and forward the online login and password which can be used to monitor investments and for further transactions. Alternatively you can invest offline by downloading the application form from the fund house’s website, forwarding the filled form alongwith the cheque for investment to the fund house. The fund house will verify the papers and open the account. The date of receipt of form will form the basis of NAV determination.

- Investment through online portals: There are online portals like www.fundsindia.com which help one choose the mutual funds to invest in and allow the facility to invest directly from their site.

Certain important things to take care of while investing

- Ensure that you fill in the bank account details properly. You may be required to provide the proof of the bank account specified in your application by way of a cancelled cheque. The said bank account with be credited for dividend and redemptions or for direct debits in case of SIP. Many investors complain that over a period of time, the specified bank account may get closed and it then becomes cumbersome to change the bank account at the time of redemption. Hence SEBI has now allowed to register five bank accounts and to specify your preferred bank account for transactions. In case the preferred account gets closed, you can choose any one of your registered bank accounts for future transactions.

- KYC Compliance: KYC is a big thing and is required for all mutual funds investment of more than Rs. 50,000. From 1st January 2011, it will be mandatory for all mutual fund transactions irrespective of the amount involved. Hence it is necessary to have yourself and your family members KYC Complaint. The process is simple. You need to visit any of the designated KYC Point of Service (check the list of Point of Service here, fill up the form and submit the address and identify proof. The service is free of cost and usually within 2 weeks you will be KYC complaint. You can check the status of your KYC on the website of CDSL. It is important to remember that the details in KYC form will override all the details which are given in mutual fund application form and hence it is necessary to have updated address in KYC to receive all communications on time.

- Timing of investment: Sometimes you purchase mutual fund units online in the evening only to realize later that the NAV of the transaction is not of the same day but one day later. You should note that the transaction should be completed by 1 pm for liquid funds (debt funds investing in short-term debt securities having duration of less than 1 year) and by 3 pm for non-liquid funds (equity and other debt funds) in order to avail the same day’s NAV.

- Nomination: Nomination is important and you should ensure that you have nominated a person who will be entrusted with your funds in the case of your death. Do remember that nomination does not means legal ownership and you need to specify the owner of your mutual fund investments in your will. More on nomination here.

Which are the best Mutual Funds to invest?

There are plethora of mutual fund schemes and all the fund houses cite their schemes to be the best based on the awards they have received or based on narrow comparisons which suits them. It is difficult to select the best mutual fund to invest and ideally you should leave that job to the experts. Bachhat prefer to choose the mutual fund scheme based on their long term performance, consistency and ability to stay within the mandate given for investment. Mint 50 list of mutual funds or www.valueresearchonline.com are good sites where you can select best mutual fund scheme. Ideally it is okay to have holdings in not more than 5-7 mutual fund schemes including debt funds and advisable to invest through SIP and not a lumpsum amount for equity mutual funds.

Do you have any more questions on mutual fund investments? Feel free to write it down in the comments section below.

Hey Vishal,

ReplyDeleteI have couple of questions on Mutual funds-

#1- How do we measure the performance of a mutual fund in context of SIP ?

#2 - To create a kind of portfolio of 'Regular-growth/High-Risk' category, do you thik one need to include debt funds in his/her portfolio? Currently I'm investing approx 10K/month thru SIP, in 3 Equity-diversified funds (growth -option).

Thanks!!

Paresh Joshi.

Dear Paresh,

ReplyDeleteValueresearchonline provides a tool to compare SIP returns of a fund with the Non-SIP returns in the corresponding period. You can calculate the SIP returns with that tool. Link: http://www.valueresearchonline.com/learning/CalcSIPReturn.asp

As regards your second question, since your objective is to growth the corpurs over a period of time, it is advisable to invest majority of your savings in diversified equity funds.

Said above, you will still require to invest a part of the savings in fixed rate instruments or in PF or EPF. The proportion of debt to equity depends on your age, risk analysis, funds requirements in the future and variability of your earning source, amongst others.

-Vishal

To select good mutual fund, you can refer to websites like www.valueresearchonline.com or morning star ratings or Mint 50 mutual funds.

ReplyDeleteThank you, I've recently been looking for info about this subject for ages and yours is the greatest I have found out till now. However, what about the conclusion? Are you sure in regards to the source?

ReplyDeleteMy web page: amphora pipe tobacco

Asking questions are truly good thing if you are not understanding something completely,

ReplyDeletebut this article provides pleasant understanding yet.

Visit my webpage : http://propertyinturkeyforsale.net/

I believe what you said made a lot of sense. But, think about this, suppose you added a little information?

ReplyDeleteI mean, I don't wish to tell you how to run your website, but what if you added something to possibly get a person's attention?

I mean "Your guide to Mutual Fund Investment" is a little boring.

You could glance at Yahoo's front page and see how they write news headlines to grab viewers to click. You might try adding a video or a pic or two to grab people excited about what you've got to say.

In my opinion, it would make your posts a little bit more interesting.

Also visit my site boligityrkia.net

Wonderful site you have here but I was curious if you knew of any message boards that cover

ReplyDeletethe same topics discussed in this article? I'd really like to be a part of group where I can get feed-back from other knowledgeable people that share the same interest. If you have any suggestions, please let me know. Appreciate it!

My homepage - bostad i alanya

Write more, thats all I have to say. Literally, it

ReplyDeleteseems as though you relied on the video to make your point.

You obviously know what youre talking about, why waste your intelligence on just posting videos to your weblog

when you could be giving us something enlightening

to read?

My web page :: diablo 3 wizard guide

Quality articles is the secret to attract the people to pay a visit

ReplyDeletethe web site, that's what this web page is providing.

My blog post samson tobacco

It's truly very difficult in this full of activity life to listen news on Television, so I only use world wide web for that reason, and get the latest information.

ReplyDeleteHere is my web-site tattoo removal

It's perfect time to make some plans for the future and it is time to be happy. I've read this

ReplyDeletepost and if I could I wish to suggest you few

interesting things or tips. Perhaps you could write next articles referring to this article.

I desire to read even more things about it!

Have a look at my web site ; drum tobacco

Can I simply say what a comfort to find a person that really knows what they are discussing online.

ReplyDeleteYou certainly know how to bring a problem to light and make it important.

More and more people have to check this out and understand

this side of your story. I was surprised you are not more popular

given that you surely possess the gift.

Check out my site : amber leaf

Thanks very nice blog!

ReplyDeletemy website - van nelle shag

Thanks designed for sharing such a nice idea, paragraph is

ReplyDeletefastidious, thats why i have read it entirely

Also visit my webpage :: how to get rid of Pimples Overnight

I am regular reader, how are you everybody?

ReplyDeleteThis article posted at this web site is really nice.

Also visit my web site ... treatment for acne

An impressive share! I've just forwarded this onto a co-worker who had been doing a little homework on this. And he in fact ordered me dinner due to the fact that I stumbled upon it for him... lol. So let me reword this.... Thanks for the meal!! But yeah, thanks for spending some time to talk about this matter here on your internet site.

ReplyDeleteMy web blog : diablo 3 wizard guide

Thanks very interesting blog!

ReplyDeleteHere is my webpage :: how to cure acne

Excellent blog here! Additionally your website rather a lot up

ReplyDeletevery fast! What web host are you the use of? Can I get your associate link on your host?

I desire my site loaded up as fast as yours lol

Also visit my web site www.turkolog.de

What i do not realize is if truth be told how you are not

ReplyDeleteactually a lot more smartly-favored than you might be now.

You're so intelligent. You realize thus considerably relating to this matter, made me for my part imagine it from numerous numerous angles. Its like women and men don't seem

to be interested until it is one thing to accomplish with Woman gaga!

Your own stuffs nice. Always take care of it up!

Here is my web page; http://wiki.diespielemacherin.de

Write more, thats all I have to say. Literally, it seems as

ReplyDeletethough you relied on the video to make your point.

You clearly know what youre talking about, why throw away your

intelligence on just posting videos to your blog when you could be giving us

something enlightening to read?

Have a look at my web-site ... http://www.mzajbook.com/index.php?do=/profile-24073/info

My website :: home business

Do you have any video of that? I'd care to find out more details.

ReplyDeleteLook into my blog: takemassageclasses.com

When someone writes an paragraph he/she maintains the idea of a user in his/her

ReplyDeletebrain that how a user can understand it. Thus that's why this paragraph is perfect. Thanks!

Feel free to visit my blog: unwanted clothing items

Hello exceptional website! Does running a blog such as this require a large amount of work?

ReplyDeleteI have no knowledge of coding but I was hoping to start my own blog soon.

Anyhow, should you have any recommendations or tips for new blog owners please share.

I understand this is off topic nevertheless I simply needed

to ask. Thanks!

Also visit my page - pickaparty.org

Your style is very unique compared to other people I have read stuff

ReplyDeletefrom. Many thanks for posting when you've got the opportunity, Guess I will just book mark this page.

Feel free to visit my webpage women dress