In November 2010, Bachhat carried out a claim

settlement analysis of life insurance companies to understand which company provides the assurance of quick

settlement of claims. The analysis

carried out in November was based on the data for the year 2009-10. Bachhat

had stated to do more such analysis in future and today we shall have a

look at how the life insurance companies have fared in their claim settlement for

the year 2010-11.

Why claim settlement analysis is important?

Before deep diving into the

analysis, let us recap why the analysis of claim settlement is important. Besides the premium charged by the insurer,

two additional important things one should consider before choosing an insurer

is the probability of getting the claim settled in the event of the death and

the time taken to settle the claim.

Nobody will like to be in a

situation where one has paid the premium diligently for 20 years and after his death,

the claim is disapproved for any reason.

One will also not like to be in a situation where his family gets the

insurance proceeds after 6 months or say even after 1 year of the death. Hence it is necessary to do the analysis of

claims settled by the insurance companies.

It will help you know which company rejects the least number of claims

and process the claims quicker.

Claim

Settlement Analysis

The table below gives the best

five and the bottom five life insurance companies in terms of claim rejection

for the year 2010-11. Best companies

have the least claim rejection ratio whereas bottom five companies have the highest

claim rejection ratio. The list is further broken down into how old these

rejected policies where when the death occurred. Older the policies less should be the chance

of rejection.

Best five insurance

companies in terms of claim rejection

Insurer

|

% Claims Rejected

|

< 2 yrs old policy

|

> 2 yrs old policy

|

LIC

|

1%

|

92%

|

8%

|

Star Union Dai-ichi

|

1%

|

100%

|

0%

|

ICICI Prudential

|

3%

|

82%

|

18%

|

ING Vyasa

|

4%

|

88%

|

12%

|

Kotak

|

4%

|

92%

|

8%

|

Bottom five insurance

companies in terms of claim rejection

Insurer

|

% Claims Rejected

|

< 2 yrs old policy

|

> 2 yrs old policy

|

Aegon Religare

|

45%

|

100%

|

0%

|

Shriram Life

|

26%

|

88%

|

12%

|

Future Generali

|

22%

|

100%

|

0%

|

IDBI Federal

|

21%

|

94%

|

6%

|

DLF Pramerica

|

20%

|

100%

|

0%

|

LIC is the best amongst the

entire lot of insurance companies with only 1% of the claims getting

rejected. ICICI Prudential and Kotak

Life are amongst the private insurance companies making it to the

best five listing.

Aegon Religare tops the

list of bottom five companies with 45 out of every 100 claims rejected during

the period under review. Shriram Life,

Future Generali Life, IDBI Federal and DLF Pramerica are other insurance

companies which have claim rejection ratio of greater than 20%.

If we notice the age of the

policies for which claims are rejected, mostly all of them are less than 2

years old. In Aegon Religare case, all

the claims rejected are for policies less than 2 years old. The relevance of 2 years is insurance company

can not reject claims for policies which are more than 2 years old on the basis that

the policy was taken based on misrepresented facts, unless the insurance

company shows that such misrepresentation was material and fraudulently made

and policy holder knew that he is misrepresenting material fact. Thus, generally unless proved otherwise by

the insurance company, claim pertaining to policies more than two years old

should get settled. However, that does

not mean that any claims made within first 2 years of the policy should be

rejected. Such claims can go for additional

scrutiny but should get settled if found in order.

Thus it becomes interesting

to know the companies which have rejected most numbers of claims for policies

greater than 2 years.

Insurer

|

% Claims Rejected

|

< 2 yrs old policy

|

> 2 yrs old policy

|

SBI

|

17%

|

58%

|

42%

|

Aviva

|

12%

|

72%

|

28%

|

ICICI Prudential

|

3%

|

82%

|

18%

|

Bajaj Allianz

|

7%

|

83%

|

17%

|

ING Vyasa

|

4%

|

88%

|

12%

|

For eg. SBI Life has

rejected 17 out of every 100 claims made.

42% of such rejected claims are for policies in force for more than 2

years. There has to be very compelling

reasons to reject such claims and it shall be interesting to know about such

reasons.

It shall also be

interesting to know how many of the claims made within first 2 years of the

policy are settled. Unfortunately, the

insurance companies are not mandated to provide such details.

Another way to look at the

claim rejection ratio is to check whether such high rejection ratios are one

time event or a regular feature. The

graph below provides claim rejection ratio for all life insurance companies for

last two years and one can notice that there has not been substantial

difference in the two years. Furthermore,

many of the companies have rejected more claims in 2010-11 as compared to in

2009-10.

Claim

Turnaround Time

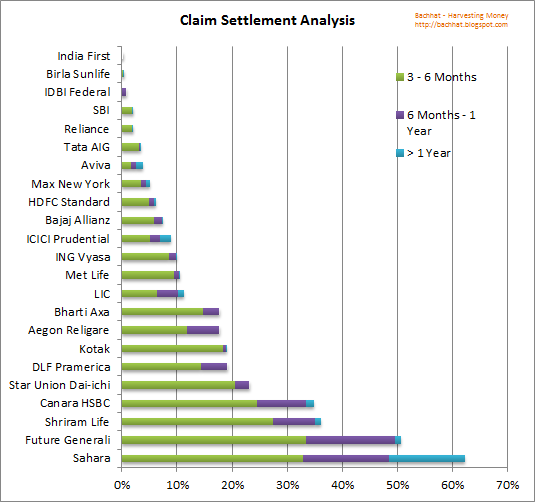

Let us now look at the time taken for insurance companies to settle the claim once they receive claim intimation from the claimant. There can be some delays due to additional documents required by the insurance companies or on account of certain queries raised on the policies. However, generally the claim settlement should not be prolonged.

There are

insurance companies where more than 50% of the claims submitted are outstanding

for more than 3 months. The graph below

provides an overview, with the quickest turnaround companies at the top and the

slowest at the bottom. The colours in

each bar represent the time taken to settle the claims.

Sahara has the worst turnaround time followed by Future Generali Life

and Shriram Life. The better way to look at this could be to see the response time once all the documents relating to claim are submitted by the claimant. Bachhat is compiling list of such instances and shall do a follow up post on the same.

Conclusion

LIC stands out with the lowest claim rejection ratio

and also a decent turnaround time. In

private sector, Kotak Life and ICICI Prudential have low claim rejection ratio. Kotak Life is better than ICICI Prudential in

rejecting claims for policies in force for more than 2 years, whereas ICICI

Prudential scores over Kotak Life in claim turnaround time.

Companies like Aegon Religare and Star Union Daichi have started operations

in last 2-4 years and we need to give them more time so that more sensible

analysis can be carried out on their claim settlement details.

Thus the cheapest term plan available may not be the

best one to opt for. One has to also

look at the company’s claim settlement ratio as well as claim turnaround time

before zeroing on any insurance company.

Have any of yours insurance claim got rejected? I shall be happy to hear your experiences, views and suggestions in the comment section below.

Post revised on January 12, 2012

Data source for analysis: IRDA Annual Report 2010-11 and Insurance companies website